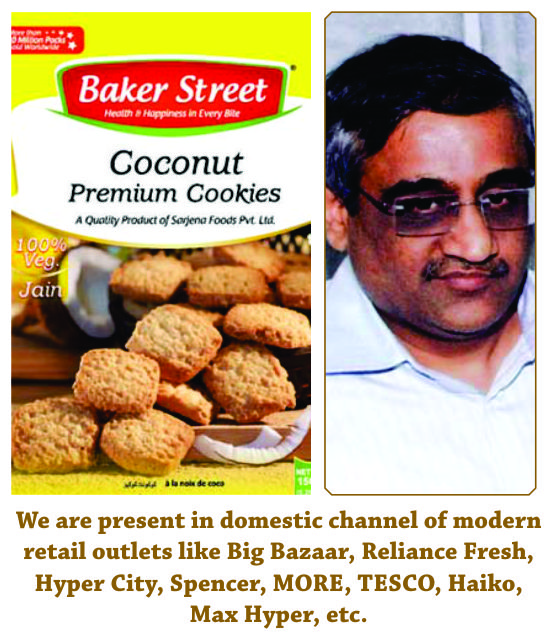

Giving shape to his plans of foraying into the dairy and bakery businesses, Kishore Biyani’s Future Group has picked up a 35 per cent stake in Mumbai-based Sarjena Foods, owner of brand Baker Street.

Sarjena Foods manufactures and distributes branded bakery products under the Baker Street brand, the company said in a filing with the Bombay Stock Exchange (BSE), without disclosing how much it paid. It manufactures and exports a variety of kharis, nan khatais, eggless cakes rusk, cookies and toasts to countries like US, Canada, UK, Australia, The Middle East And The Far East.

The firm has already launched a range of fusion Khari like Mexican, Cheese garlic and Szechuan and plans to launch more such products.

Future Group’s infusion will be utilised for setting up additional infrastructure, creating brand awareness and expanding the distribution network.

IndusAdvisors acted as the sole financial advisor to Sarjena Foods for this transaction. In December last year, Future Group had exited Capital Foods, maker of products under the brands Ching’s Secret and Smith & Jones, selling its 44percent stake in Capital Foods to a European PE fund Artal Group for Rs1,80crore.

Sitting on a cash surplus of Rs4,00crore, the company aims to become a Rs1,00,00 crore FMCG player in another five-six years for which it is planning new joint ventures with multinationals for introducing personal care products and acquisitions in India to get into the dairy and bakery businesses.

Biyani had recently signed a long-term agreement to launch food and beverage brand Sunkist in India through a long-term licensing agreement. It was also negotiating with Actis Capital to buy Nilgiris, a Bangalorebased supermarket chain which derives its revenues from royalty and by selling bakery and dairy products to the franchisee stores.

Future Group which has been undergoing a restructuring programme, hiving off non-core assets to bring down its debt, is now looking at acquiring brands. One the one hand, Future group had successfully sold apparel brands AND and Biba that came under Future Lifestyle and, on the other hand, it had shelled out around Rs 1,50crorefor picking up stakes in footwear firms Tresmode and Famozi Shoes, a designer wear chain called Mineral and apparel brands Desi Belle, Giovani and Coupons.

It had recently bought a minority 12 per cent stake in Unico Retail, a Delhi-based company which sells handbags, belts and wallets under the brand Peperone.

With a stock price of Rs 8, the company has a market cap of Rs 1,320 crore. It had clocked revenues of Rs3,42.8croreand a profit after tax of Rs 30.4 crore last fiscal.